san antonio sales tax rate

What is Texass tax rate. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax.

The Texas state sales tax rate is currently.

. This rate includes any state county city and local sales taxes. This includes the rates on the state county city and special levels. The 78216 San Antonio Texas general sales tax rate is 825.

The latest sales tax rate for San Antonio TX. Texas residents 625 percent of sales price less credit for. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax.

The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to pay in. The average cumulative sales tax rate in San Antonio Texas is 823 with a range that spans from 675 to 825. 2020 rates included for use while preparing your income tax.

The December 2020 total local sales tax rate was also 63750. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. The property tax rate for the City of San Antonio consists of two components.

1000 City of San Antonio. The Fiscal Year FY 2023 MO tax rate is 33011 cents. There is no applicable county tax.

What is the sales tax rate in San Antonio Florida. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

The 78216 San Antonio Texas general sales tax rate is 825. The minimum combined 2022 sales tax rate for San Antonio Florida is. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

The sales tax jurisdiction. US Sales Tax Texas. The district is located entirely within the San Antonio MTA which has a transit sales and use tax but the district does not include any area within the city of San Antonio.

Maintenance Operations MO and Debt Service. This is the total of state county and city sales tax rates. This is the total of state and county sales tax rates.

Download all Texas sales tax rates by zip code. The San Antonio sales tax rate is 825. The minimum combined 2022 sales tax rate for Bexar County Texas is.

The sales tax jurisdiction. Counties cities and districts impose their own local taxes. There is base sales tax by Texas.

The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax. The current total local sales tax rate in San Antonio NM is 63750. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. San Antonios current sales tax rate is 8250 and is distributed as follows. While many other states allow counties and other localities.

Calculator for Sales Tax in the San Antonio. 0125 dedicated to the City of San Antonio Ready to Work Program. Does Texas have sales tax.

Florida Sales Tax Rates By City County 2022

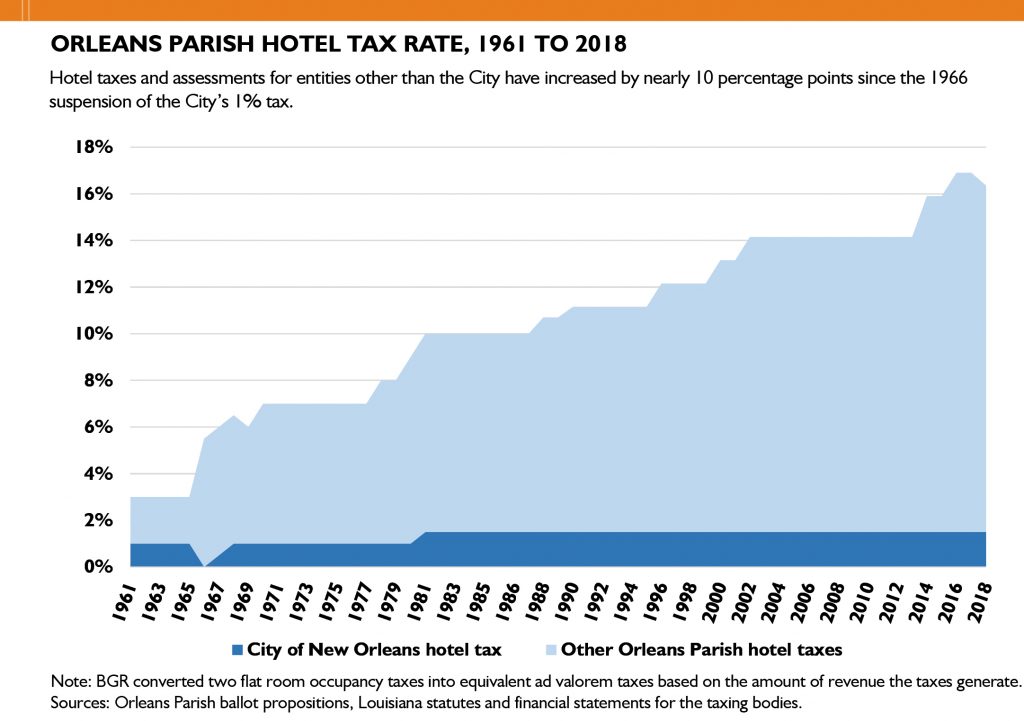

Bgr Analyzes The Orleans Parish Hotel Tax Structure

Understanding California S Sales Tax

Bad Takes Texas May Not Have An Income Tax But Most Residents Pay More Taxes Than Californians Texas News San Antonio San Antonio Current

New Mexico Sales Tax Rates By City County 2022

Texas Sales Tax Small Business Guide Truic

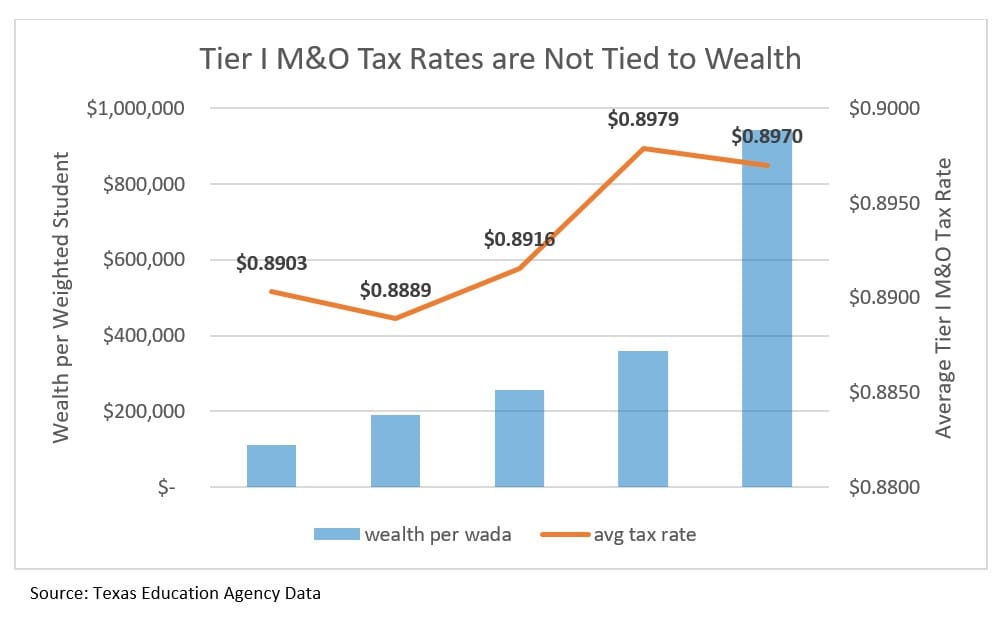

A New Division In School Finance Every Texan

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Texas Has Third Highest Property Tax Rate For Single Family Homes Study Finds

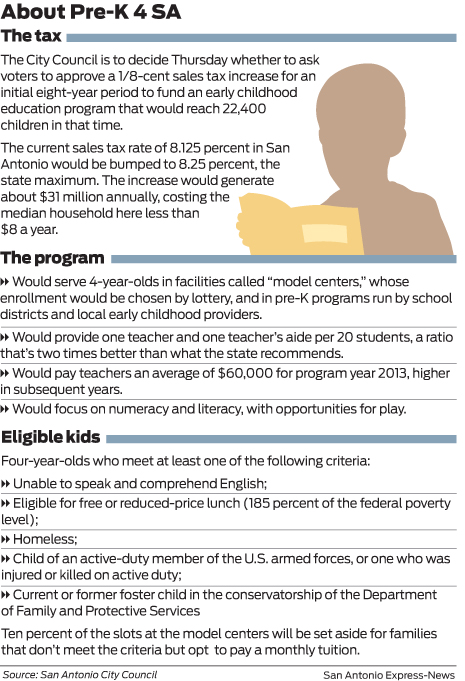

Mayor Rolling The Dice On Pre K

Texas Sales Tax Guide For Businesses

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Irs Announces Inflation Adjustments For Tax Rates In 2023 The New York Times

Why Are Texas Property Taxes So High Home Tax Solutions

Property Tax Information Bexar County Tx Official Website

Property Taxes Are A Concern But Caution Is Urged Utsa Today Utsa The University Of Texas At San Antonio